In the global industrial manufacturing sector, stability has long been the bedrock of strategic planning. However, as we enter 2026, the era of predictable, low-cost consumable tooling is officially coming to an end.

For procurement managers and distributors across the construction, automotive, and woodworking industries, a new reality is taking shape. Based on current supply chain data, geopolitical friction, and shifting monetary policies, the price of high-performance circular saw blades is projected to increase by a minimum of 10% in Q1 2026. This is not a temporary fluctuation; it is a structural correction driven by a “perfect storm” of three macro factors: the weaponization of critical minerals, the restructuring of China’s export incentives, and the escalating costs of global compliance.

This article dissects these drivers to help you understand the “Why” behind the numbers and how to navigate the volatile market ahead.

1. The Weaponization of Raw Materials: Tungsten and Cobalt

The most immediate catalyst for the 2026 price surge is the tightening supply of the core ingredients of modern tooling: Tungsten and Cobalt.

For decades, Tungsten Carbide (WC) has been the industry standard for saw blade tips due to its extreme hardness and heat resistance. However, Tungsten is no longer just an industrial input; it has been reclassified by major powers (including the US, EU, and China) as a “Strategic Critical Mineral.”

-

Supply Deficits: As of 2026, global geopolitical tensions have led to stricter export controls on Tungsten ores. With China controlling over 80% of the global tungsten supply chain, recent environmental restrictions and strategic stockpiling for domestic defense industries have significantly reduced the export quota available for the general market.

-

The “Cobalt Cliff”: Cobalt, used as the binder in carbide tips, faces even fiercer competition from the electric vehicle (EV) battery sector. As EV production targets ramp up globally in 2026, tool manufacturers are being priced out of the market by battery giants.

Impact: The raw material cost for premium carbide tips has risen by approximately 15-20% year-over-year. For a finished saw blade, where the carbide tip represents the highest value component, this single factor drives a net price increase of 4-6% at the factory gate.

2. The End of Subsidies: China’s Export Tax Rebate Overhaul

For the past twenty years, global buyers have benefited from China’s aggressive export tax rebate policies, which effectively subsidized the cost of Chinese-made tools by 13%. That era is over.

In late 2025, facing external trade pressure and a desire to move up the value chain, China announced a comprehensive overhaul of its VAT rebate system. For energy-intensive and resource-heavy products—a category that includes steel bodies and standard carbide tools—the export rebate has been either drastically reduced or eliminated entirely.

Why this matters: Previously, a Chinese manufacturer could offer a price of $100 and receive $13 back from the government, effectively operating on a $113 revenue basis. With the removal of this rebate, the manufacturer faces an immediate 13% revenue gap. To survive and maintain the same meager profit margins, factories have no choice but to pass this cost directly to the international buyer.

This policy shift alone mathematically necessitates a price correction of roughly 9-13%, independent of material costs.

3. The Hidden Cost of Geopolitics: “Friend-Shoring” and Compliance

The 2026 global trade environment is fragmented. The decoupling of supply chains—often referred to as “de-risking” or “friend-shoring”—introduces new, hidden operational costs.

-

Steel Body Volatility: High-quality saw bodies rely on specialized alloy steels (like 75Cr1). As trade barriers rise between steel-producing nations (such as tariffs between Europe and Asia), manufacturers are forced to source materials from more expensive, “politically safe” alternatives or pay high tariffs on imported premium steel.

-

ESG and Carbon Taxes: The European Union’s Carbon Border Adjustment Mechanism (CBAM) is now in full effect. Saw blades, being steel-heavy products, are subject to carbon audits. The administrative cost of tracking, reporting, and paying for the carbon footprint of every blade is being baked into the FOB price.

The 2026 Outlook: A New Pricing Baseline

When we combine these factors, the math is undeniable:

-

Raw Material Inflation (Carbide/Steel): +4% to +6% impact.

-

Export Policy Adjustment: +5% to +10% impact.

-

Operational/Logistics Inflation: +2% to +3% impact.

Total Projected Increase: A conservative estimate places the baseline price hike at 11% to 19% for high-quality industrial blades. The “10% increase” warning you are receiving is not a sales tactic; it is, if anything, an optimistic forecast that assumes manufacturers are absorbing some of the pain.

Strategic Recommendations for Partners

In a rising market, passivity is expensive. We recommend the following actions for our partners:

-

Lock in Q1/Q2 Pricing: If you have forecasted demand for the first half of 2026, finalize your orders immediately. Current inventory produced under 2025 cost structures is your most valuable asset.

-

Shift to PCD Solutions: While the initial cost is higher, Polycrystalline Diamond (PCD) blades offer a lifespan 30-50 times that of carbide. In an environment where replacement costs are rising (due to logistics and labor), the Total Cost of Ownership (TCO) of PCD becomes significantly more attractive.

-

Prioritize Supply Security: In 2026, availability will be as critical as price. Partner with manufacturers like KOOCUT who have secured long-term raw material contracts and possess the financial stability to weather supply chain disruptions.

The market has changed. The cheap, abundant resources of the past decade are gone. But for those who plan ahead, 2026 offers an opportunity to consolidate market share by securing stable, high-quality supply while competitors struggle with shortages and price shocks.

Post time: Jan-09-2026

TCT Saw Blade

TCT Saw Blade HERO Sizing Saw Blade

HERO Sizing Saw Blade HERO Panel Sizing Saw

HERO Panel Sizing Saw HERO Scoring Saw Blade

HERO Scoring Saw Blade HERO Solid Wood Saw Blade

HERO Solid Wood Saw Blade HERO Aluminum Saw

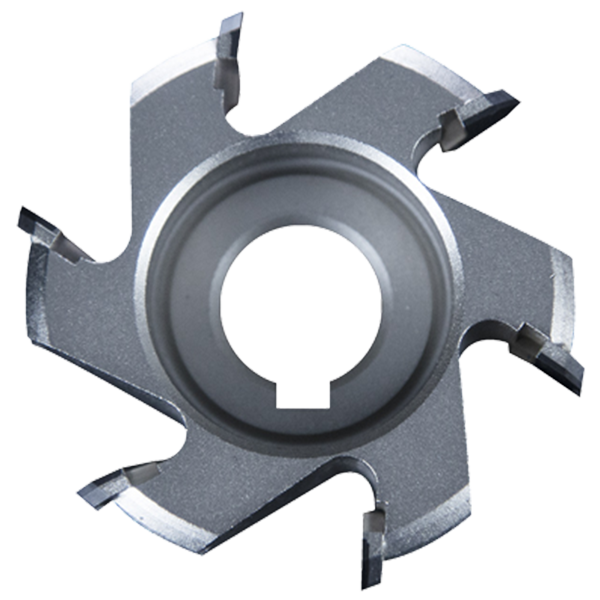

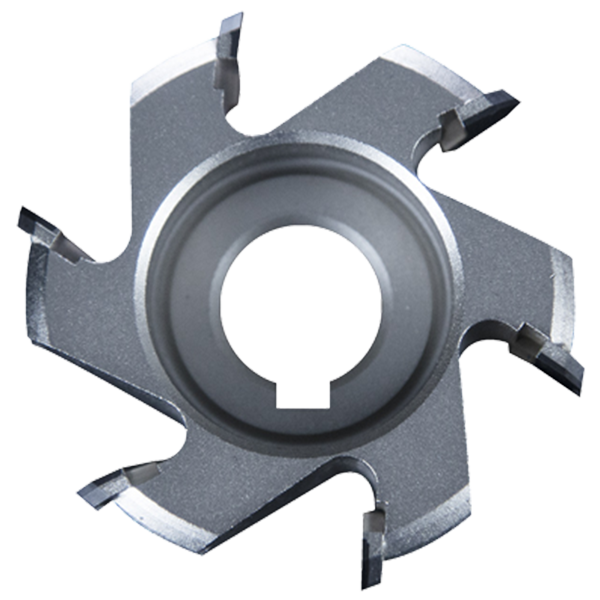

HERO Aluminum Saw Grooving Saw

Grooving Saw Steel Profile Saw

Steel Profile Saw Edge Bander Saw

Edge Bander Saw Acrylic Saw

Acrylic Saw PCD Saw Blade

PCD Saw Blade PCD Sizing Saw Blade

PCD Sizing Saw Blade PCD Panel Sizing Saw

PCD Panel Sizing Saw PCD Scoring Saw Blade

PCD Scoring Saw Blade PCD Grooving Saw

PCD Grooving Saw PCD Aluminum Saw

PCD Aluminum Saw Cold Saw for Metal

Cold Saw for Metal Cold Saw Blade for Ferrous Metal

Cold Saw Blade for Ferrous Metal Dry Cut Saw Blade for Ferrous Metal

Dry Cut Saw Blade for Ferrous Metal Cold Saw Machine

Cold Saw Machine Drill Bits

Drill Bits Dowel Drill Bits

Dowel Drill Bits Through Drill Bits

Through Drill Bits Hinge Drill Bits

Hinge Drill Bits TCT Step Drill Bits

TCT Step Drill Bits HSS Drill Bits/ Mortise Bits

HSS Drill Bits/ Mortise Bits Router Bits

Router Bits Straight Bits

Straight Bits Longer Straight Bits

Longer Straight Bits TCT Straight Bits

TCT Straight Bits M16 Straight Bits

M16 Straight Bits TCT X Straight Bits

TCT X Straight Bits 45 Degree Chamfer Bit

45 Degree Chamfer Bit Carving Bit

Carving Bit Corner Round Bit

Corner Round Bit PCD Router Bits

PCD Router Bits Edge Banding Tools

Edge Banding Tools TCT Fine Trimming Cutter

TCT Fine Trimming Cutter TCT Pre Milling Cutter

TCT Pre Milling Cutter Edge Bander Saw

Edge Bander Saw PCD Fine Trimming Cutter

PCD Fine Trimming Cutter PCD Pre Milling Cutter

PCD Pre Milling Cutter PCD Edge Bander Saw

PCD Edge Bander Saw Other Tools & Accessories

Other Tools & Accessories Drill Adapters

Drill Adapters Drill Chucks

Drill Chucks Diamond Sand Wheel

Diamond Sand Wheel Planer Knives

Planer Knives